Portugal, my home-country is no longer under an external financial assistance program.

In the aftermaths of the 2009 financial crisis, this country with such unsustainable public accounts fell, but now is speeding up.

I think it’s time to see how did the PIIGS – Portugal, Ireland, Italy, Greece and Spain – perform over these years. If they achieved their goals, or if they did not.

To make things clear, i analysed the following data:

1) Real GDP,

2) Unemployment,

3) Budget balance,

4) Public gross debt,

5) Exports and trade balance (goods and services),

6) Industrial production,

7) Share of population at risk of poverty.

Real GDP

In the aftermaths of the 2009 financial crisis, Ireland suffered the most immediate decline on GDP. Then it recovered a bit.

Italy and Portugal are less than 5pct of the pre-crisis level.

Greece, the less affected by the crisis in 2009, continues to be in a downward spiral and lost almost a quarter of its output.

Unemployment

Unemployment shoot up all across the Old Continent.

As countries entered the crisis with different unemployment rates, I focus in change of unemployment rate instead of the rate itself.

Between 2008 and 2013, unemployment rates jumped between 5pct and 10pct in Italy, Ireland and Portugal. 15pct in Spain. Almost 20pct in Greece.

memorandum: 2013 unemployment rates – Portugal 16.5pct, Ireland 13.1pct, Italy 12.2pct, Greece 27.3pct, Spain 26.1pct

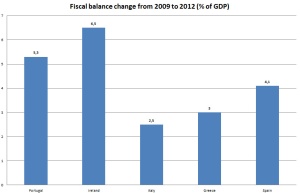

Budget balance

PIIGS have always run big deficits (except in some particular cases, as Spain in the housing boom).

Undoubtedly, Italy had its accounts more “under control” in the beginning of the crisis. Perhaps, this is why they did the smallest fiscal consolidation efforts.

I used the overall balance instead of the primary balance, that could be better to analyse troika policies, by two reasons: the first it’s that data referencing to primary balance it’s not so easily available, and second, the most important, debt burden it’s so heavy in these countries that it does not make any sense to try to dissociate this burden from public accounts. We’ll not repay it in the next years. We will do in decades, so overall budget makes more sense, although affected by individual measures (as privatizations).

Portugal and Italy have deficits below 5pct of GDP. Greek accounts keep without control, and budgetary deficit keeps persistently above 10pct.

Public gross debt

Running big deficits means increasing indebtedness.

Italian public debt rose 26pct between 2008 and 2013. Portuguese, Spanish and Greek debt rose between 50pct and 65pct. Irish debt rose almost 80pct. We shall not forget that some of the Greek debt outstanding had a tremendous haircut in mid-2012, that we can see in the graphs. This haircut affected bilateral loans with European countries, debt owned by the ECB, national central banks and EFSF(European Financial Stability Facility).

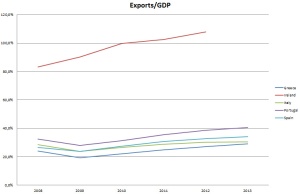

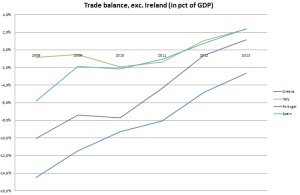

Exports and trade balance (Irish data only available until 2012)

Due to falling prices and real wages, due to retraction in public consumption, trade balance improved. Imports fell sharply (more than 30pct in Greece). Exports, stagnant in Greece and Italy, rose near 20pct in Portugal, Spain and Ireland.

Ireland was excluded from the last graph, because its reality concerning external trade is totally different. From a 9pct surplus in 2008 to 24pct surplus nowadays.

Ireland improved its trade balance by 15pct of GDP (until 2012). Greece and Portugal improved it by 12pct and 11pct respectively. Spain by 8pct and Italy by 3pct.

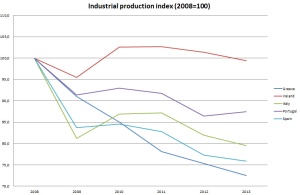

Industrial production

In Ireland, the crisis wasn’t matched by a fall of industrial production. It remained mostly unchanged.

In Portugal, industrial production fell 12pct, in these 5 years. In Spain and Italy, it fell 24pct and 20pct, respectively. Greek industrial production tumbled almost 30pct.

Share of population at risk of poverty

I decided to include this indicator, as a measure to see how badly population was affected by austerity policies. Obviously, this measure is too broad, but I found it interesting: population at poverty risk increased in almost all european countries, specially in the PIIGS. But, in the so devalued Portugal, it fell. Actually, with or without social transfers, Portuguese people has a lower risk of poverty than their equivalent peers.

Conclusion

As Schaeuble said:

Steadfast programme implementation has allowed Portugal to bring its economy back on track, put public finances on a path to sustainability, and reduce imbalances that had been building up before the crisis

There’s no big conclusion to take, just some good data to grab.

Now, in my personal opinion, austerity policies were very important to slash fiscal imbalances that these countries where living in, since the beginning of the euro, and sometimes, since the beginning of its democracies.

From now, every country must do a commitment to not destroy all the work that was done. Every single country now should increase spending only when revenue or favorable financing is available.

Interest rates are down. In the Portuguese case are in all-time lows. But that’s not an opportunity to stupidly borrow; it’s an opportunity to pay less for borrowing the amounts countries really need!

I cannot leave this text without blaming the IMF when they designed such assistance plans. The risk of recession was very badly accessed and the small differences of the IMF wrong multipliers has result in billions of euros of unnecessary austerity and lost economic output.

Portugal is on track to be a healthy country in my point of view. No trade deficit, budget under control, unemployment falling, GDP up 1.2pct y-o-y. Meanwhile, high indebtedness and degradation of the trade balance (as Portuguese purchase power recovers, imports will be up and exports may retreat) are the big downside risks for our economy. And the same applies for Ireland, Italy and Spain.

In the Greek case, we must not forget the risk of deflationary spiral. Well, I think they’re currently living one. I defend tight fiscal policies, but perhaps some measures should be postponed in Greece, until better external conditions are found.

Thank you for reading. Any doubt/error/suggestion, tell me.

All data from Eurostat and national statistics bureaus.